The representative of the People’s Procuracy at the appellate level also suggested that the first-instance judgment be annulled because many issues related to the conclusion of the contract, the compensation claim and the request for fines for violations were not clear. The People’s Court of Lam Dong province has just heard the appellate court annulled […]

Search Results for: tư vấn luật

PROCEDURES FOR BUSINESS TRADE REGISTRATION AT VINHOMES CENTRAL PARK

Trademark registration is an urgent and extremely important thing for trademark owners to protect their intellectual property. Trademark owners who want to protect their trademarks must register for protection at a competent State agency. With many years of experience in the field of implementation trademark registration procedures for businesses at Vinhomes Central Park as well […]

Enterprise Law 2020: 04 contents expected to be amended

In order to meet the requirements of practice to remove difficulties and obstacles in corporate governance, production and business investment activities, a number of contents of the 2020 enterprise luaath are expected to be revised, As follows: Regarding the disclosure of information on the mid-year financial statements of state-owned enterprises. – At Point d, Clause […]

EXPENSES FOR CONSIDERATION AND ASSESSMENT AT ONLY IN THE SETTLEMENT OF CIVIL CALLS – INTERESTING AND PROPOSAL, RECOMMENDATION

During the settlement of civil cases, if the involved parties request or deem it necessary, the Judges shall conduct the on-the-spot consideration and appraisal. The on-site examination and appraisal is mainly carried out for cases in the first instance stage, that is, measuring the current state of the disputed land, examining objects, architecture, trees and […]

Case law: Some theoretical and practical issues

Make a problem An important feature of the rule of law is to have a complete legal and judicial system. The current Vietnamese legal system still has many contradictory, outdated or inadequate legal regulations to settle disputes in society. This will make it very difficult for the justice system to carry out its function of […]

LEGAL PROVISIONS ON STANDARDS FOR Appointment of cadres IN STATE AGENCIES

In order for readers to have a clear understanding of the legal provisions regulating the conditions and standards for the appointment of leading positions in State agencies, here is a summary of the relevant legal documents as follows: The system of legal documents stipulating standards and conditions for appointment of cadres includes : Joint documents […]

10 new points about salary and bonus from 2021 employees need to know

The Labor Code 2019 (Labour Code 2019; effective from January 1, 2021) stipulates many new points about wages and bonuses that employees need to know to ensure their legitimate rights and interests in the relationship. the labor system with the employer (employer), specifically: Employers must not force employees to use their salaries to buy goods […]

Labor contract in 2021: 10 new points employees need to know

Many new points in the Labor Code 2019 on labor contracts that employees need to know to ensure their legitimate rights. Increase the recognition of actual labor relations Additional provisions: Any contract, regardless of its name, is considered a labor contract if it has all 3 signs: – Working on an agreement basis; – Paid […]

Principles of division of common property of husband and wife upon divorce

couple who carry out the divorce procedure must, of course, be attached to an agreement on the division of common property because after the Court settles the divorce, the property and personal rights of the two are independent. Upon divorce, the settlement of property will be agreed upon by the parties; In case no agreement […]

Procedures for initiating a land dispute

Land dispute resolution is a lengthy process involving several stages. Mediation is the first and mandatory stage. After the conciliation of land disputes at the commune-level People’s Committees fails, the disputing parties are entitled to carry out the procedures to initiate a lawsuit over the land dispute. The procedure for initiating a lawsuit for a […]

How to determine the property value when the land purchase and sale contract is void?

Is there a legal basis for determining the value of assets when settling a void land purchase and sale contract by taking the average price of the involved parties? Image for illustration purposes only (Internet source) Case content: […]

Supervision of judgments and decisions of district courts – Issues raised

Supervision of court judgments and decisions plays an important role in ensuring the accuracy, groundedness and lawfulness, protecting the legitimate rights and interests of citizens and organizations, and contributing to ensuring the law. uniform implementation law. Legal basis of supervision of judgments and decisions of district courts On the basis of the duties and powers […]

Important legal issues to know when buying an apartment

Choosing to buy a completed apartment is a way for buyers to immediately meet housing needs and limit legal risks when buying apartments formed in the future. However, the apartment has been completed and can be moved in immediately; However, buyers still need to distinguish whether they are buying an apartment in the following cases […]

Registration for adjustment of investment projects

If you are wondering how to register to adjust an investment project, DHP LAW will answer this question through the following article: Condition: 1/ Investment projects whose adjustment is related to the objectives, scale, location, form, capital and duration of the investment project. 2/ The adjusted investment projects do not fall into the following cases: […]

The latest guidance of the Ministry of Finance on reducing VAT to 8%

On March 23, 2022, the Minister of Finance issued Official Letter 2688/BTC-TCT guiding the reduction of VAT to 8% according to Decree 15/2022/ND-CP . Accordingly, the Ministry of Finance guides 02 contents on VAT in Decree 15/2022/ND-CP as follows: 1.About groups of goods and services not eligible for VAT reduction Clause 1, Article 1 of […]

Some notes on CIT finalization 2021

In order to support businesses and organizations to well perform the CIT declaration and finalization of the 2021 CIT period, the Hanoi Tax Department pays attention to the taxpayers some of the following contents: List of CIT finalization declaration forms (depending on the actual arising of each taxpayer): – Corporate income tax return (applicable to […]

General Department of Taxation: Compulsory use of electronic invoices from November 1, 2020

The General Department of Taxation issued Official Letter 2578/TCT-CS dated June 23, 2020 answering questions about the mandatory time to use e-invoices. General Department of Taxation: Compulsory use of electronic invoices from November 1, 2020 – On September 12, 2018, the Government issued Decree 119/2018/ND-CP , which stipulates: “ Article 35. Implementation effect … During […]

Employees can register as dependents for the following people to reduce PIT

An employee is entitled to deductions for family circumstances for his or her dependents if the employee has registered for tax and is granted a tax code when calculating personal income tax. Accordingly, according to the provisions of Circular 111/2013/TT-BTC , employees may register for deductions for dependents in the following cases: (1) Children: natural […]

Family circumstances deduction increased to 11 million

Deputy Secretary General of the National Assembly said that the National Assembly Standing Committee had agreed to increase the personal income tax deduction from 9 to 11 million dong. At a press conference on the afternoon of May 18, Mr. Nguyen Truong Giang – Deputy Chairman of the Law Committee and Deputy Secretary General of […]

Deductible and non-deductible expenses when determining taxable income

(According to Article 4 of Circular 96/2015/TT-BTC dated June 22, 2015 effective from August 6, 2015) Except for non-deductible expenses mentioned in Clause 2 of this Article, enterprises may deduct all expenses if they fully satisfy the following conditions: a) Actual expenses incurred in connection with production and business activities of the enterprise. b) The […]

OBJECTS TO APPLICATION OF EXTENSION OF TAX PAYMENT AND LAND RENTAL

In the face of a very complicated situation of the Covid-19 epidemic, causing damage to people, halting economic, cultural and social activities, affecting business and production activities of enterprises, organizations, households and individuals. To support people and businesses, on April 8, 2020, the Government issued Decree 41/2020/ND-CP stipulating the extension of time for tax payment […]

CASE OF PERSONAL INCOME TAX EXemption and reduction in 2019

Legal grounds Law on Personal Income Tax 2007 Law amending and supplementing a number of articles of the personal income tax law 2012 Law amending and supplementing a number of articles of tax laws 2014 Cases of personal income tax exemption and reduction in 2019 Tax-free income Income from real estate transfer between husband and […]

POLICIES FOR TAX INCLUDE FOR SOFTWARE, INFORMATION TECHNOLOGY AND SCIENCE AND TECHNOLOGY

Currently, the tax policy system has many preferential policies, supporting the development of information technology and science and technology industries. In order to improve the competitiveness of software, information technology and science and technology enterprises, promote investment attraction for information technology development according to the set objectives in the context of economic integration. As international […]

Edit 5 tax laws: Synchronous reform of the tax system

The implementation of tax laws has contributed positively to the country’s socio-economic development. However, when the level of integration is increasingly expanded, the domestic and foreign economies fluctuate, which has put a requirement to amend and supplement tax policies to suit reality… From this urgent request, implementing the Resolutions of the Politburo, the National Assembly […]

General Department of Taxation: Compulsory use of electronic invoices from November 1, 2020

The General Department of Taxation issued Official Letter 2578/TCT-CS dated June 23, 2020 answering questions about the mandatory time to use e-invoices. General Department of Taxation: Compulsory use of electronic invoices from November 1, 2020 – On September 12, 2018, the Government issued Decree 119/2018/ND-CP , which stipulates: “ Article 35. Implementation effect … During […]

Establishing a science and technology enterprise

Science and technology enterprise means an enterprise that directly conducts scientific research and technological development activities as well as production and business activities of all kinds of products from the results of such scientific research and technological development. . Business products of science and technology enterprises are tangible or intangible products. Due to the special […]

08 legal jobs businesses need to do in October 2019

DHP Law would like to share the following tasks that businesses need to do in October 2019: Before October 3, 2019: Announcement of labor changes in September 2019 (Based on Clause 2, Article 16 of Circular 28/2015/TT-BLDTBXH dated July 31, 2015). The deadline is October 20, 2019: Submit personal income tax return for September 2019 […]

Some attentive things about the accounting corporate income tax in 2021

In order to support businesses and organizations to well perform the declaration and finalization of corporate income tax of the corporate income tax period of 2021, the Hanoi Tax Department pays attention to the taxpayers some of the following contents: List of corporate income tax finalization declaration forms (depending on the actual arising of each […]

Establishing a Science and Technology Enterprise

Science and technology enterprise means an enterprise that directly conducts scientific research and technological development activities as well as production and business activities of all kinds of products from the results of such scientific research and technological development. . Business products of science and technology enterprises are tangible or intangible products. Due to the special […]

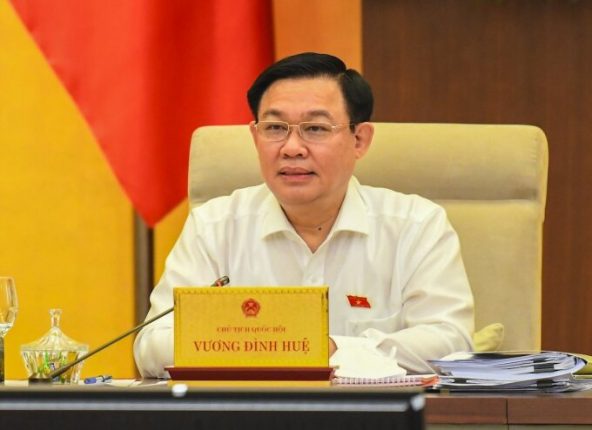

THE PRESIDENT OF THE NATIONAL ASSEMBLY: NO LAW ISSUED, THE NATIONWIDE WAIT FOR INSTRUCTIONS

Mr. Vuong Dinh Hue said it was “not convincing” if the revised Law on Insurance Business had to wait until mid-2023 to apply because there was no time to have a guiding document. According to the proposal of the drafting agency, the draft Law on Insurance Business (amended) will take effect from July 1, 2023, […]

About Us

INTRODUCE DHP Law Firm Is a combination of practicing lawyers, accounting, finance and corporate governance consulting, including: DHP Law Firm, Law Office Tran Duc Hung and Associates, A2Z Investment and Consulting Joint Stock Company and its member companies, associate companies was established in 2012, operating mainly in the field of consulting, implementing legal procedures on […]